This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Retail Intelligence 2020: are retailers giving consumers what they want?

Written by bego ·

What were the reasons behind stores closures in 2019? Which channels were most effective at generating sales? What are the main challenges retailers will face at the start of this new decade? We answer these questions in our annual “The Future of Retail Intelligence 2020” report in which we surveyed 600 retail ecosystem professionals and 600 consumers to analyse what has changed over the last 365 and answer the question on everyone’s minds: Are retailers giving consumers what they want? Interested in finding out what we discovered? Read on.

365 days of change: 2018-2019 comparison

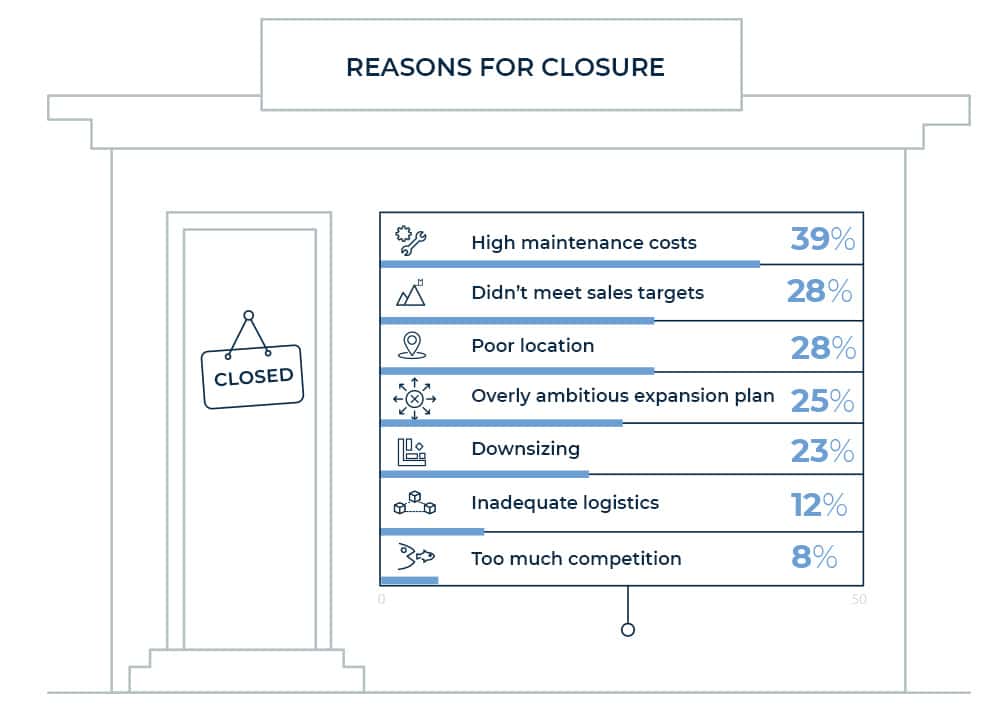

The results from our survey confirmed 2019 as the year with the most store closures in history—increasing by 22% when compared to 2018. We also uncovered the main reason as to why they closed: high maintenance costs (39%), failure to meet sales targets (28%) and being in the wrong location (28%).

Moreover, we saw that the percentage of retailers who said they were planning to open new establishments in 2020 dropped to 63%—8 percentage points lower than last year. These figures suggest an end to expansion as the sole strategic driver of growth, paving the way to network optimisation. Diversified growth will gain traction this year, allowing retailers to adapt their offerings according to varying market contexts, managing their points of sale without multiplying costs.

Take a look at a recent example: The famous Spanish fashion retailer, Adolfo Dominguez, is optimising its retail network. In 2019, the firm closed out the year with 130 fewer stores than in 2016. However, they reported a higher turnover.

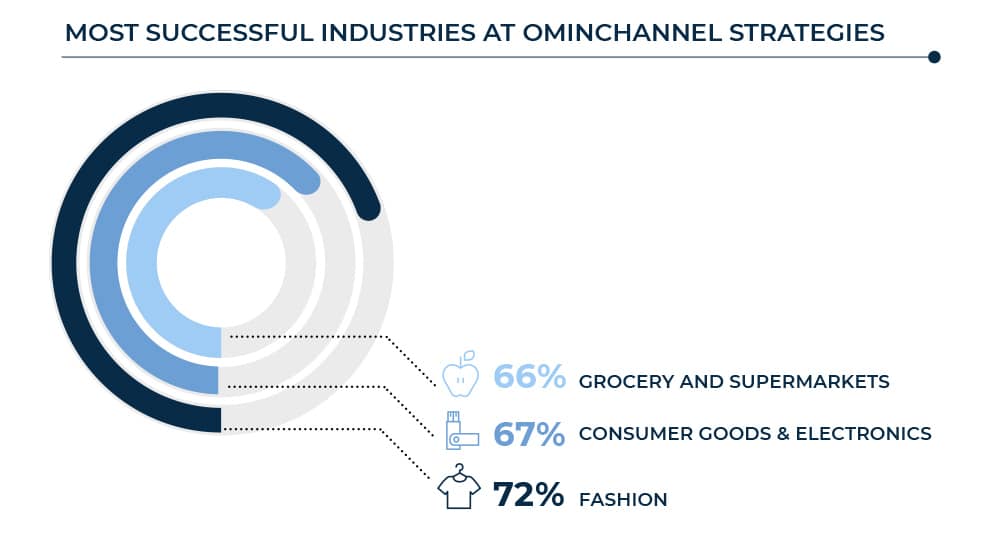

And speaking of fashion brands, we have good news! 72% of fashion retail professionals said to be successful or very successful at implementing omnichannel strategies to connect and interact with customers—the highest percentage among all the retail categories we surveyed. This was followed by Consumer Goods and Electronics (67%) and Grocery and Supermarkets (66%) who also claimed to have omnichannel under control.

We were interested in understanding what criteria retailers were taking into consideration when calling themselves “omnichannel”. Blending offline and online sales, having omnichannel payment options such as “Click & Collect”, launching integrated marketing campaigns and being present on social networks were the main requirements these professionals believe make a retailer truly omnichannel. But is that enough? There has been some recent criticism taking shape in the industry, led by Steve Dennis, creator and advocator of a new concept called “harmonised retail”. Dennis believes that we shouldn’t forget “a great consumer experience has never consisted of being everywhere and being all things to all people“, but of being there at the right moment in customer journey, connecting physical and digital channels harmoniously. Having the ability to draw conclusions as a means to eliminate friction points in the shopping experience and amplify memorable moments is fundamental when creating a winning customer experience strategy in the new age of retail.

To give you more context, watch the video of a conference Steve Dennis participates in discussing “harmonised retail in-depth” followed by an example of how Sephora has integrated technologies in the quest to offer its consumers a quality shopping experience, always understanding that “online presence drives physical shopping and vice versa”. The challenge is to find a way for all implemented actions to coexist in harmony and give customers the interactions they want.

Key Challenges for Retailers

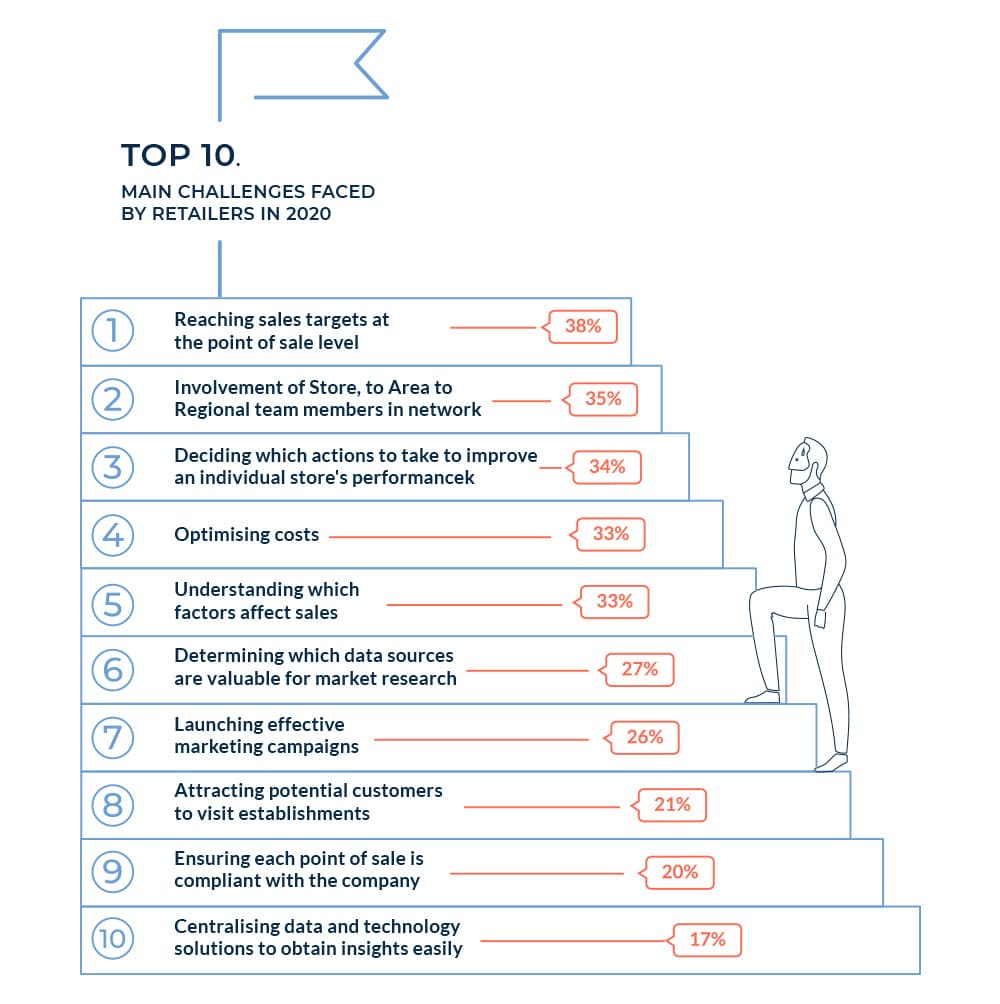

As we have seen, retailers have a busy schedule in the race to win over consumers while maximising their businesses profitability. But what other challenges do they face? To start this new decade on the right foot and understand what it will take to survive the much-feared “retail apocalypse,” we asked industry professionals about their main challenges. What were the results? According to retailers, reaching sales objectives at each point of sale (38%) is the greatest difficulty they face, followed by successfully involving the right team members throughout the network (35%) and deciding what actions to take to improve the performance of each particular store (34%).

State of the relationship between retailers and consumers

In the second part of the report, we go a step further, asking consumers if retailers are really giving them what they want. Our survey results highlight several discrepancies.

A good in-store experience is the most-valued by consumers when choosing a brand, but 48% of retailers are doing nothing about it. On the other hand, 48% of consumers claimed they would stop buying a brand if it’s not sustainable, while 56% of brands are not implementing any sustainability measures. In short, there is a clear mismatch between retailers and consumers. This translates into a loss of opportunities for the retailer and forces the consumer to look for alternative options to have their needs met.

Here’s a video of how Nike has improved the experience in one of its stores in New York for more inspiration:

What else has changed in the retail ecosystem over the last 12 months?