This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

State of the Retail Ecosystem 2020: Impact of COVID-19

Written by bego ·

In recent weeks, everyone in the UK has witnessed how COVID-19 has taken its toll on our country. It’s already forced the UK to close its bars, restaurants, hotels, cinemas and shops. In fact, the only commercial establishments that remain open now are those selling basic necessities. But it hasn’t stopped there. Everyone living in the UK has been forced to stay at home and remain in lockdown, waiting for this pandemic to be controlled. We can only leave to go to the supermarket, the pharmacy or to get to a place of work. Although not all countries have adopted the same measures, there are many other countries going through the same situation: Spain, France, Italy, Argentina, Australia… and more are adopting similar measures every day. Obviously, the consequences haven’t been slow in coming, and the retail sector has suffered many of them.

State of the retail ecosystem in 2020

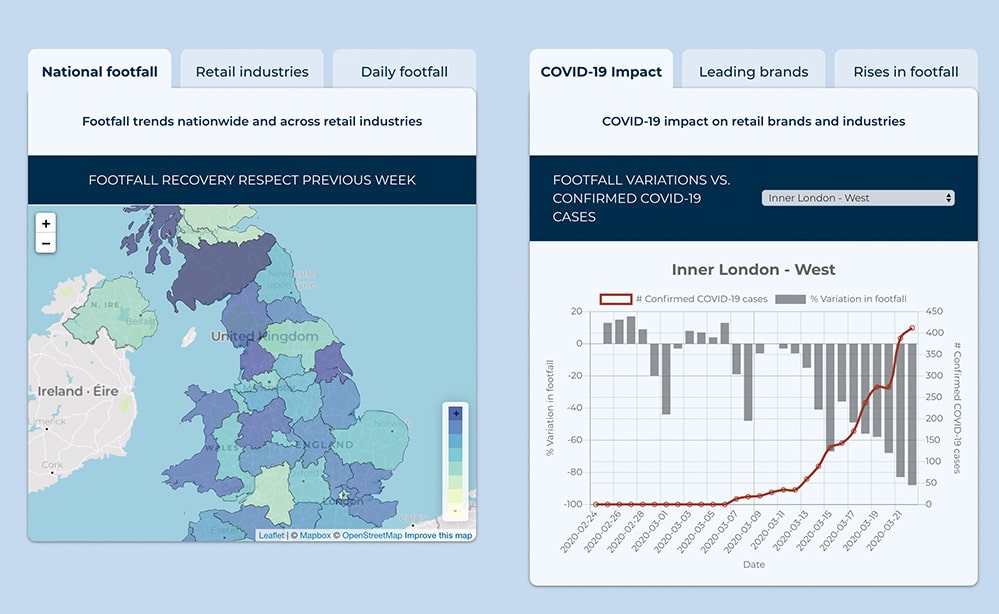

In order to support the sector, we’ve launched an open, free portal which will be updated weekly, where professionals of the retail ecosystem will be able to see how COVID-19 is impacting different territories and industries. Thanks to this resource, professionals within the sector can access information about their populations’ mobility and consumption, with the aim of addressing some business decisions related to the current events.

Footfall in times of crisis

In Dublin, footfall fell by up to 77% and, according to Springboard, fell by 41% on the UK high street even before the government-imposed restrictions. Take, for example, supermarkets. These are among the few shops that remain open, some even extending their opening hours to meet the existing demand. But, how has footfall varied between these establishments? Which brands are attracting the most traffic? How have footfall trends changed in relation to the number of confirmed cases of COVID-19?

Marks & Spencer experienced the greatest decrease in footfall nationwide, with a 73% drop pedestrian traffic around their retail locations.

Changes in shopping journeys

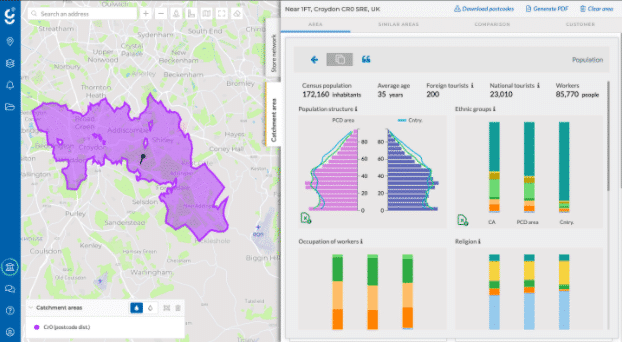

In “normal” times, some consumers are willing to travel to get to their favourite supermarkets. Other people vary their shopping habits, going to one supermarket one week and to another, another week. At the moment, people are simply going to their nearest supermarket, without any exceptions. This means that—for many points of sale—their target audience has changed drastically. For example, if the catchment area was previously 10 minutes by car, now it will be, at most, a 10-minute walk. We’re all trying to minimise the risks and that means being outside the house for as little time as possible.

These changes in consumer behaviour require retailers to meet these challenges by exploring new opportunities. For example, through analysing who their current consumers are, in order to modify distributions strategies and to be able to meet consumers’ real demands. Thinking about it, in an area where there are many families, there’s going to need to be a higher stock of nappies than in an industrial area, right?

Here we can see that the postal district of Croydon has a large number of children 0-10 years old, which suggests that supermarkets in the area will need a larger stock of nappies.

Reinventing yourself in times of crisis

The current crisis has brought about a major change in consumer behaviour and therefore, in brand activity. So, it’s essential to perform both quantitative and qualitative analyses. We need to do this in order to adapt our product offerings and modify our operational activity to give consumers what they need and make the most out of resources in this difficult economic time.

We would like to invite you to visit our portal to monitor COVID-19’s impact on consumer behaviour and new trends in footfall. Here you will find:

- Daily changes in footfall in relation to the number of confirmed cases of coronavirus in specific counties.

- Analysis and benchmarking of 12 retail categories that are generating footfall during this crisis.

- Ranking and analysis of the footfall of 10 brands from 12 different categories (120 in total).

- Weekly evolution of footfall, both nationally and in the different counties, to monitor its evolution.